As a next step, as non-expert of portfolio management, i found interesting books and papers making different use of the nobel-prize Markowitz strategy, AKA mean-variance portfolio https://en.wikipedia.org/wiki/Markowitz_model (MPT Modern Portfolio Theory) applied to 10 common stocks from the Nasdaq100.

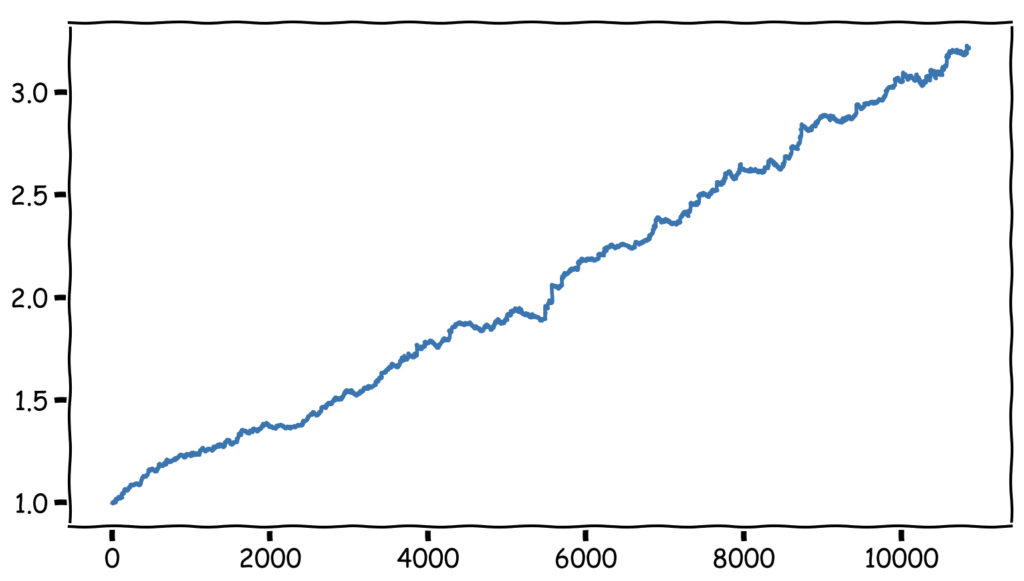

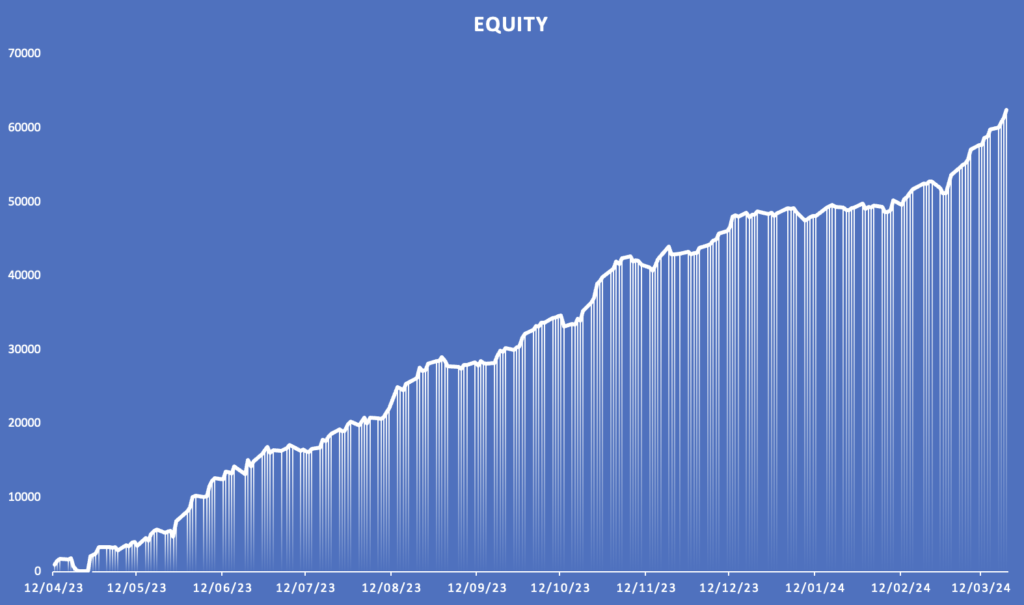

The applied algorithm doesn’t allow for trades at every timeframe (15m, hour, day) thus some theories cannot be applied (e.g. fixed allocation, long strategy, etc.), however the best portfolio and weights with lowest risk that was found brought to a CAGR = 0.5402, SHARPE RATIO = 9.5759, MAX DRAWDOWN = 2,6948%.

A different approach would be to apply the 1/N heuristic that is a simple investment strategy where an investor allocates an equal proportion of their total capital across N assets. It offers some advantages, that is it simple and it may reduce the unsystematic risk associated with individual asset (it is not guaranteed that past behavior will be the same as future behavior), but it’s not optimal in terms of risk-adjusted return since it treats all assets equally, regardless of their risk/return characteristics.

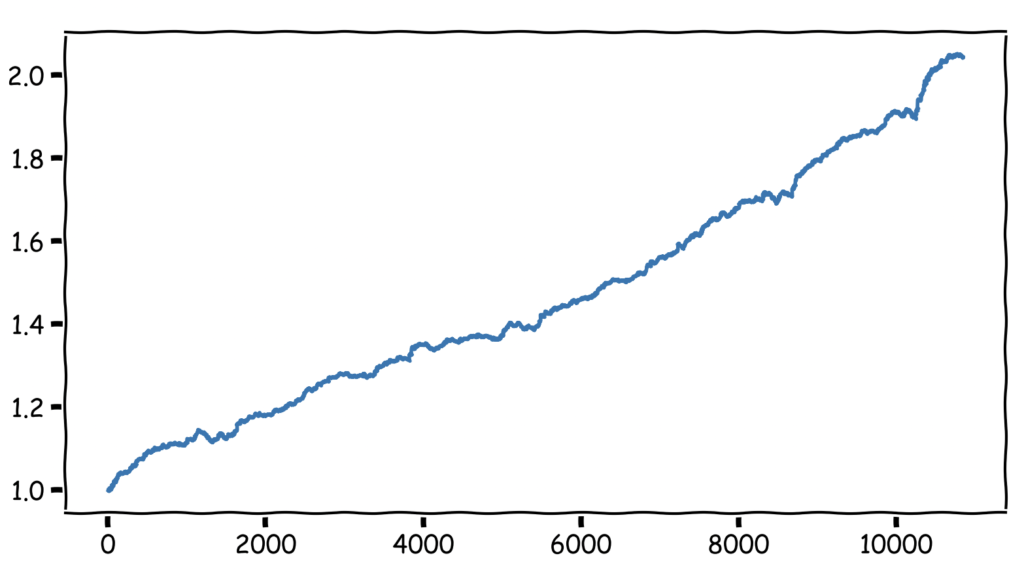

The underlying selection follows a fast and frugal approach that is selecting first the underlying with acceptable risk (e.g. Max Drawdown) and then picking the 10 best performing. Resulting CAGR = 1.0249, SHARPE RATIO = 10.0465, MAX DRAWDOWN = 3,2248%